Visa - The moat is eroding - Part 1

I am very excited to share this new project:

This First Post from our new newsletter is finally here, in cooperation with my Friend.

The first post is posted on both newsletters, but after that, it will only be posted on the new Payments newsletter below.

Introduction

My friend and I often meet to discuss payments, the newsletter, his startup and other projects we both have.

We both work in Payments.

Let me introduce him. Bright, who previously worked in MBB consulting, in Strategy at PayPal and now works in a scale up fintech. His background covers Africa, the USA and Europe.

Let me introduce myself: Olivier, I worked in PayPal, I now work in High risk e-commerce covering payments. My geographic background is in various countries in Europe. (I also write the emerging value newsletter and I am a contrarian value/growth investor).

We both have links to PayPal, Ireland and Africa. We did not meet in Paypal but rather through a chance encounter in Barcelona.

We are different people.

He is more of a builder, I am more of an investor. He is more of a doer, I am more of a writer. (Although I have a project for France in my mind).

Bright also brings more knowledge of the US consumer that I do not have. So it will make an interesting combo.

The last time we met, we came to the idea that we could do a journal on payments, mixing strategy analysis, work experience and investment takeaways. We could make it interesting and it would allow us to widen our horizons, get more knowledge on payments, connect with people (in relation to projects) and also launch another side business with the newsletter eventually.

How we will work: I will prepare the investing side of a company/theme with questions, we meet and cover it, exchange some docs, and I put the article in place from the transcript.

Why is this newsletter different? It’s not going to be simplistic and say:

“look, revenue grew X percents so the company is great” or “Visa has a partnership with a stablecoin platform so instead of fearing stablecoins they embrace it”. This is too simplistic.

We are going into the qualitative aspects, the strategy and we will think critically about the companies. It’s going to challenge the companies, ourselves and my long ideas too.

These articles will be based around a conversation transcript and edited to have a structure with key points. In some parts I would leave the actual transcript, and in other parts summarise the points spoken.

Now let's dive into it.

VISA

Starting a newsletter on payments with a Visa article is the perfect introduction.

First the basics:

How does Visa value creation work?

1 - VISA value creation.

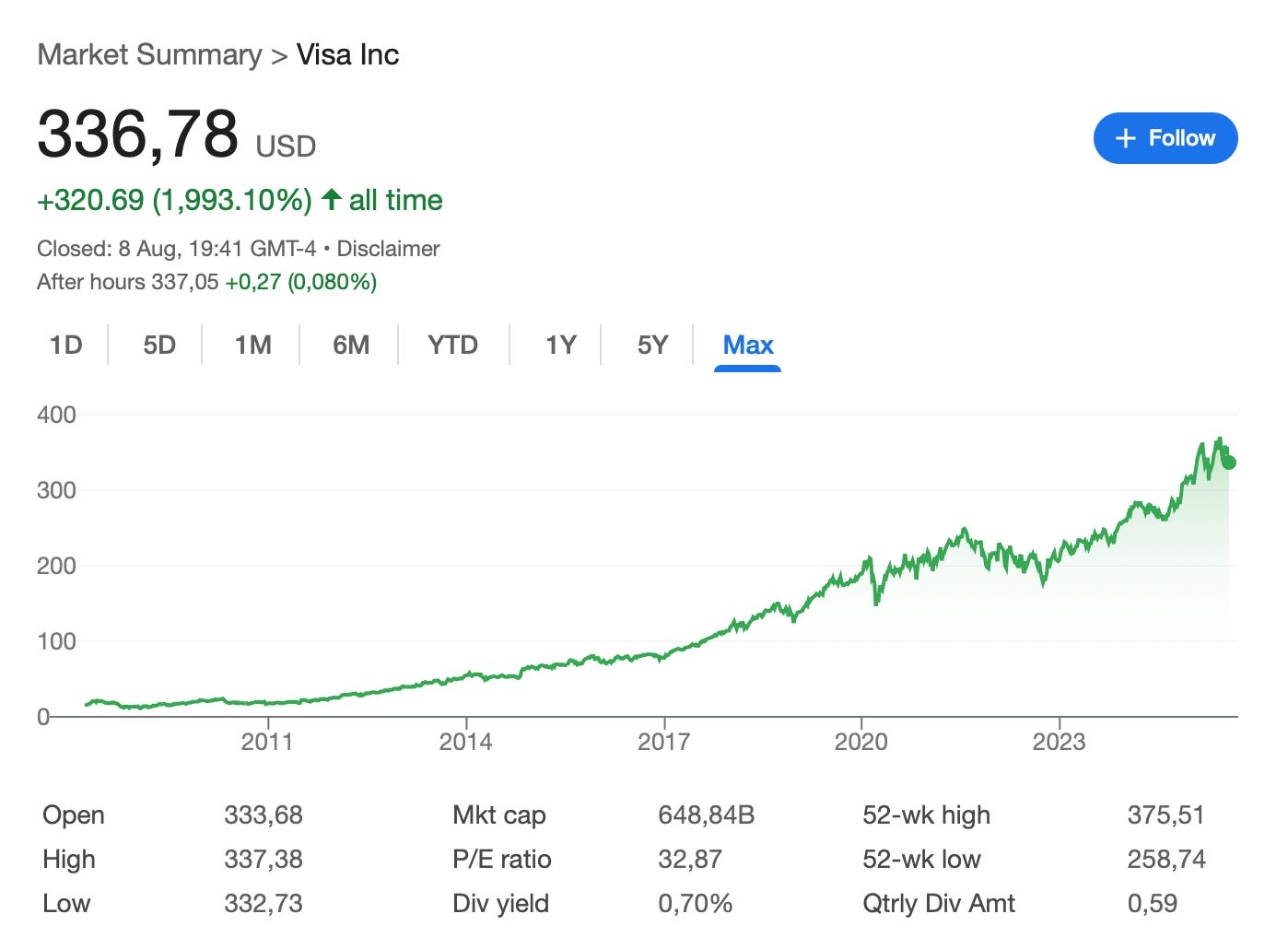

Visa has been a great performer and is now a staple quality stock.

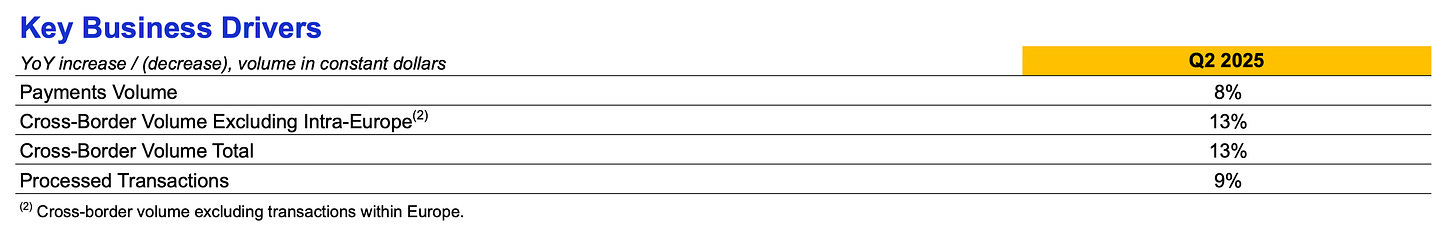

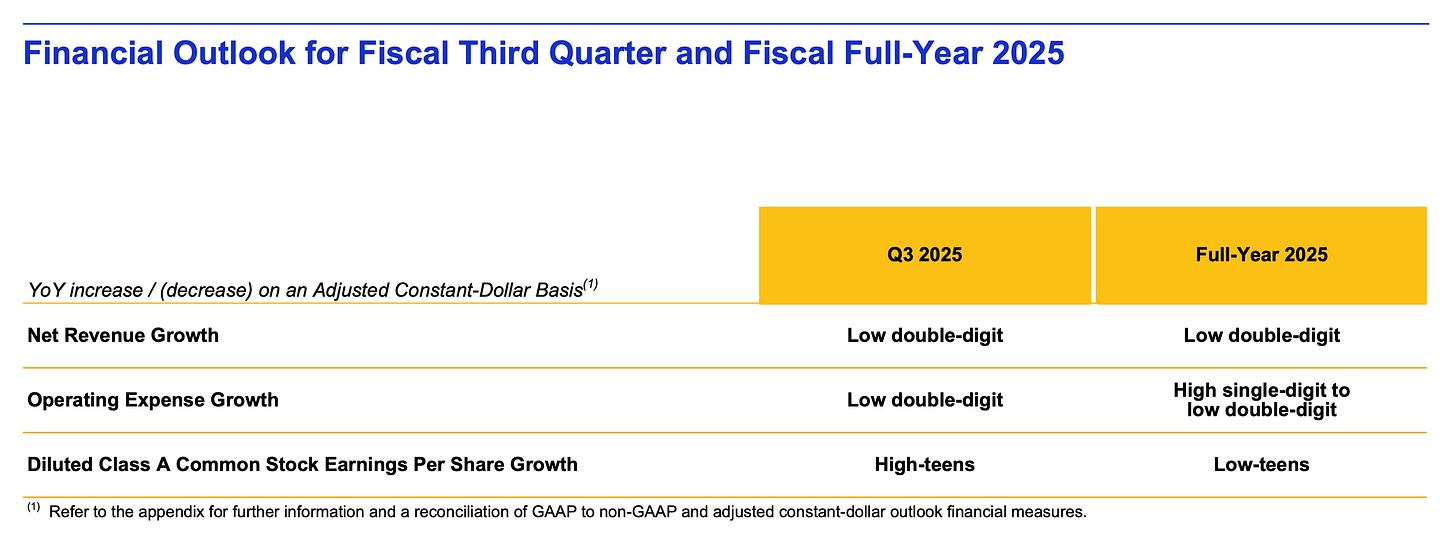

Visa is able to grow payment volumes at around 8% a year as of Q2 2025. Combined with other fees and services, and good cost control of a capital light business, it is able to be a high quality compounder growing around 12% EPS a year as we can see below:

It pays a small dividend and returns most cash to shareholders with buybacks. Visa forward P/E ratio is elevated at 27, so the programmatic buybacks, that Bright criticises as a gimmick to push the price up, are done at very low return on invested capital (around 3%). Which is a problem for me. As I noted in my previous value investing articles, buybacks are not included in ROIC due to accounting standards, but they are invested capital to the core.

The outlook for 2025 is a low teens EPS growth, showing the current efficiency of the business model.

Overall, the current business is doing very well and it could justify the valuation for the market if the current trends continue in the long term.

2 - VISA business segments.

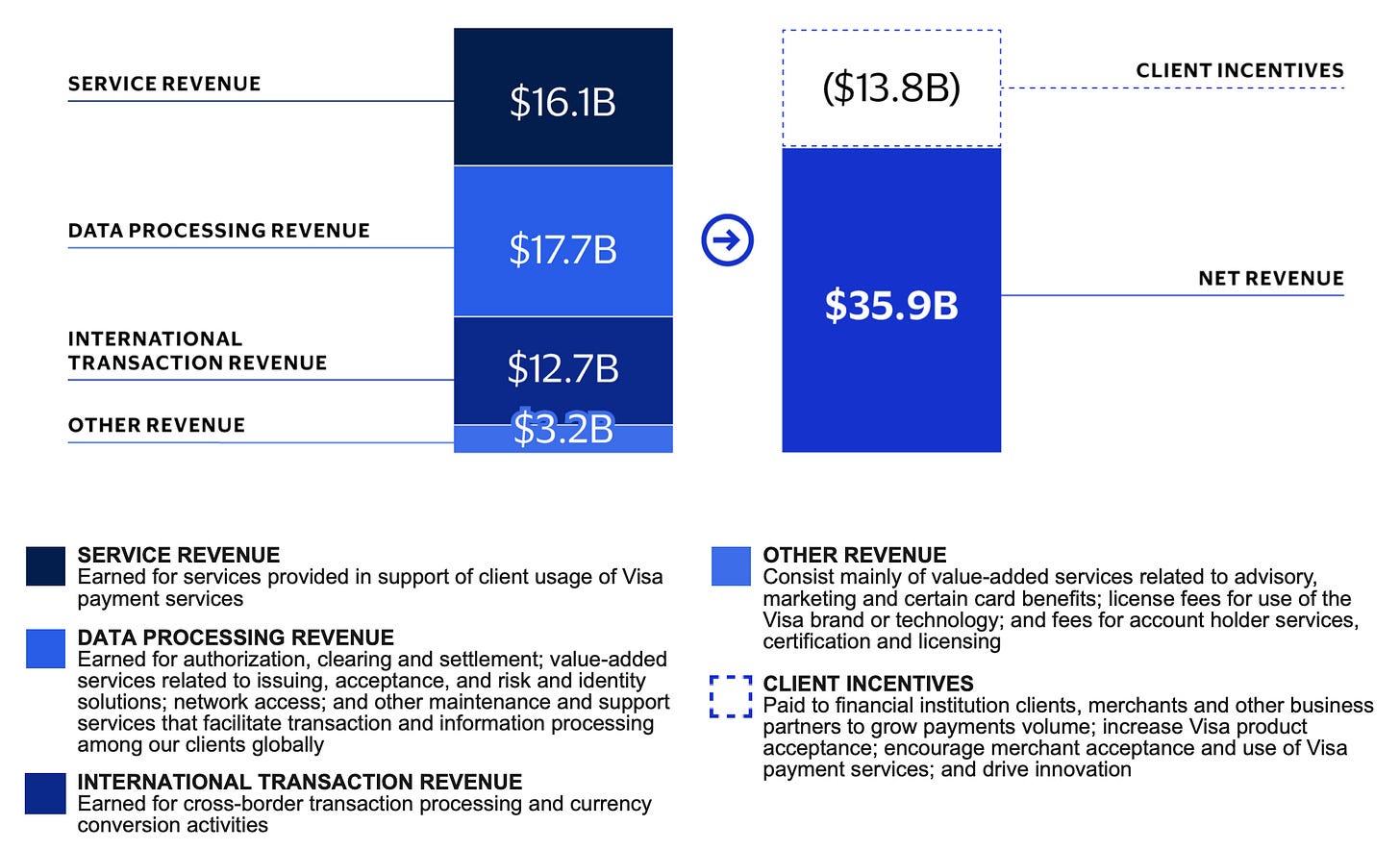

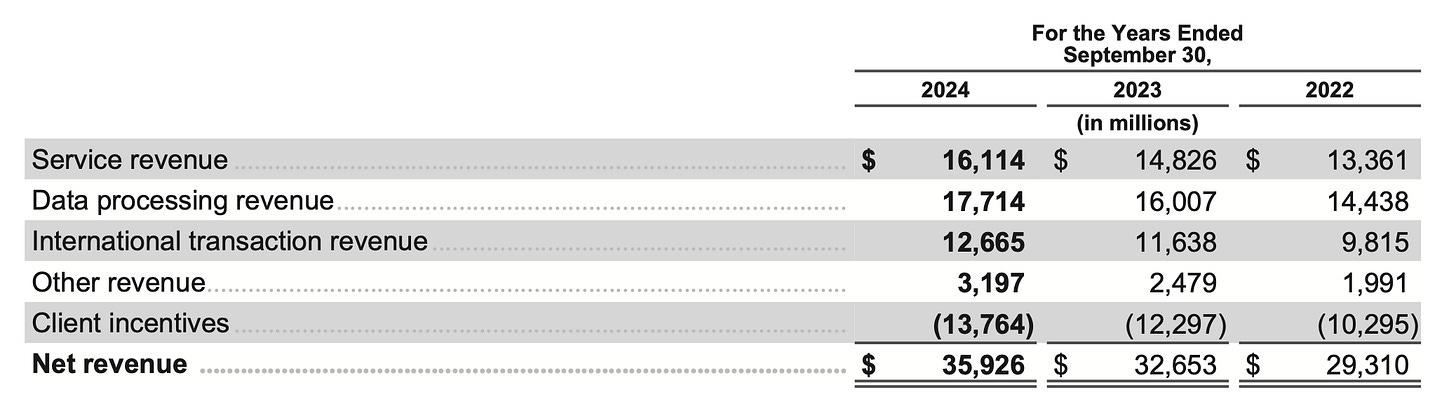

The reporting by visa is opaque because data processing revenue is not clear, other revenue as well, and client incentives are deducted to get to net revenue. Let’s open the 10k:

We see that Service revenue is up 8%, Data processing is up 10% and Other revenue is up 29% year on year. Most of the growth comes from other revenue, in percentage terms.

In the 10k, they explain that pricing is a good explanation for the rise in the other revenue.

“Other revenue increased in fiscal 2024 over the prior year primarily due to growth in marketing and consulting services and select pricing modifications.”

The other revenue+Data processing revenue= Visa Fee hiking?

That is one reason why merchants dislike Visa and Mastercard:

Here I will give examples of what is in my experience, a Visa abuse of fees.

Visa will introduce new fees and penalties if your fraud risk is above 2.2%, and 1.5% in 2026, and had similar penalties in the past if your dispute level was elevated.

Great you might think, merchants should not have fraud. Right?

But here is a secret. 90% of the time it’s misclassified by Visa, we can clearly see that it’s not fraud but buyer remorse. just someone changing their mind or not liking the service. How can we see? IP, purchase patterns, contacts to customer service, etc.

So VISA doesn’t actually use their data because any sophisticated system would reject 80% of these claims as bogus. The customer has a right to be dissatisfied, but this should be classified as a non-fraud type of dispute, and they should contact the merchant for a refund first.

So either they don’t have enough data, or they don’t use the data, or they profit from the fees related to these claims and let them happen.

That is step 1: new penalties and fines for “FRAUD” - that is not really fraud.

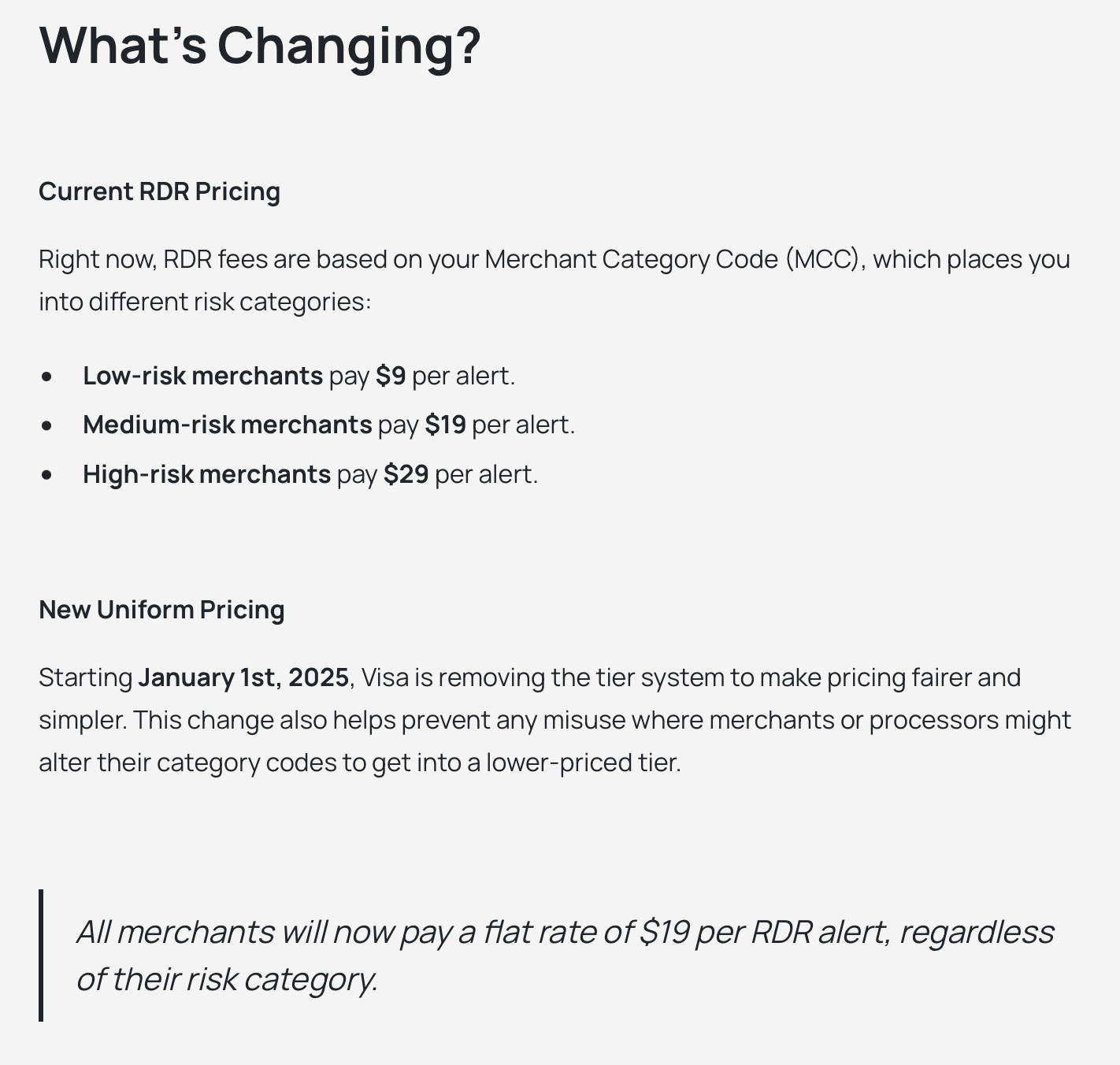

So if you want to be under the limit to avoid fines or risk of termination? No problem,

Visa magically appears and sell you a new service to reduce your “FRAUD” -(that is not really fraud)- if you pay for the service.

This new service does not prevent the disputes or fraud -(that is not really fraud)- There is no AI or machine learning to prevent these abused cases. Or at least I did not notice any decrease. The new service that you pay for does the following:

instead of receiving a fraud dispute, you receive a fraud alert (for something that is not really fraud). Then you refund it automatically - forfeiting your right to denounce this fake fraud - and by some magic, you are now avoiding the penalties. There is no difference apart that the name of the event is alert instead of chargeback.

And for each Fraud alert, of course, you receive … A fee! So you don’t pay less fees when you use this extra service.

Prior to that, you paid a Chargeback fee, but it went to the acquiring bank. Now, Visa gets that fee instead, in form of an Alert fee.

It is often more expensive, or it could be equivalent. But you need to use it to avoid expensive fines.

And Visa does not have to manage the merchant rights to respond, saving administrative costs on potential arbitrations (the appeal phase of disputes). The merchant, even if they shipped the item or service and have all the proof, are incentivised to just refund and take a loss from a fake dispute in 80% of cases, because just trying to prove that you are right will increase your official fraud ratio.

So, merchants have largely lost their right to defend against chargebacks, or they must pay more fees and risk penalties just for that.

That is step 2: forcing you to use an expensive service to avoid penalties. (By the way, Mastercard did something similar with its own Alert service).

Here is an example of a potential hidden fee hike:

Externally, we do not know how it impacts Visa revenue. But it’s possible that there are more alerts for low risk merchants than for high risk merchants, and the total fee collected per RDR alert increases for Visa. But no one can say that Visa is increasing fees, as they can say that they are just unifying fees (Verifi).

I think this is where a lot of the extra growth has been coming from, and it is probably very profitable, for some services that add no value to the merchants, other than preventing penalties.

It might just be a small example of data processing revenue, and I am sure that there is real data processing revenue in the mix. But if it grows faster than payment volume, it is some sort of fee hike, hidden, and this is widespread. All merchants have to use this, and more and more onboard these “services”.

For the other revenue, Bright noted that Visa has also been buying up a lot of startups. So maybe they're just packing that revenue from the startups there.

In conclusion, I suspect that this is how visa is able to provide some extra revenue growth is mostly with fee hikes and forced selling, and this is how it is able to generate EPS growth in the double digit range.

In the next part of VISA, we will cover;

The potential growth of VISA total addressable market to take share from Cash and Bank transfers, and what we think about it. (Part2)

The disruption challenges to VISA and the conclusion. (Part3)

This will only be available here, so if you are interested, subscribe to Payments strategy and investing below:

Thanks!

This is why we need a new payment network in EU like PIX in Brazil. Visa no longer provides enough value to justify these crazy fees.

I think BNPL also poses a real threat to the credit card companies. Those companies haven’t quite gotten their act together so far, but they offer similar value for merchants and are preferred by many consumers.